TL;DR: Uncertainty is permanent, gambling is the new planning, and you're gonna need more than one map of the terrain

Mentioned in this edition: Golden Globes, Venezuelan ex-president Nicolas Maduro, Nassim Nicholas Taleb (a great edition for various Nicholii), Polymarket, Press Secretary Karoline Leavitt, Credit Default Swaps, KPop Demon Hunters, Steve Jobs, ChatGPT, Claude, Chris Kalaboukis, Steve Brown, and you. Of course you, always you. The centerpiece of this pièce de résistance.

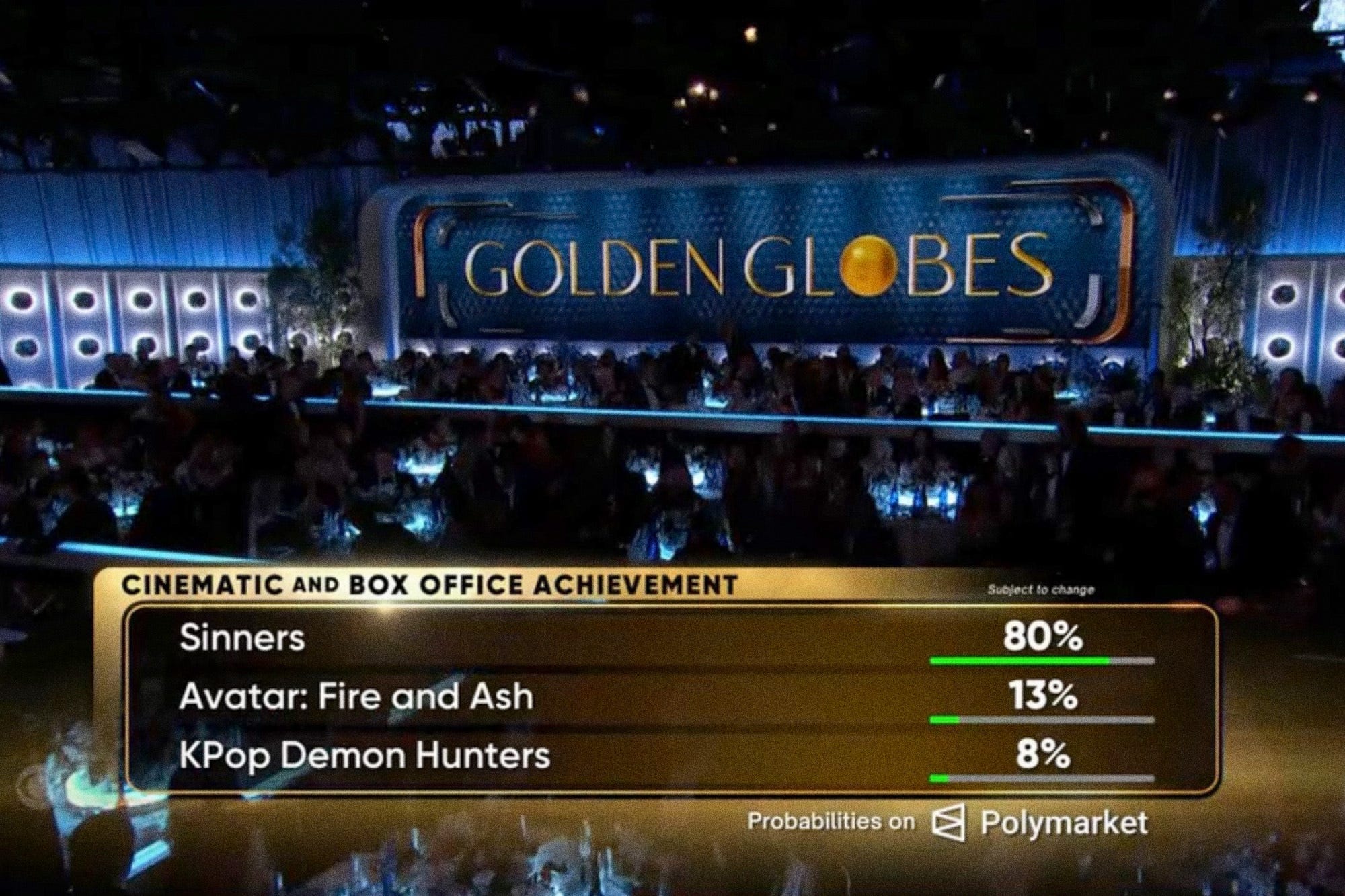

When I watched the chyron glow with the Polymarket prediction that there was an 80% chance that Sinners was about to win best Blockbuster at the incredibly sad Golden Globes last Sunday, I knew we needed to talk about it.

Don't misread me, this isn't one data point makes a trend kind of BS, this is holy cow the trend I've been watching for the last six months is now so normalized as to be ridiculous and we're long overdue for a chat. And not about the Globes, (though if you're here for that message me... I have THOUGHTS.) about the reinvention of reality, markets, economies, and culture to some form of After Prom Carnival where the bulk of people are playing stupid games, winning stupid prizes and a select few anonymous others are making $400,000 winning a bet that Venezeula's president would fall, conveniently hours before he did.

If you're unfamiliar, Polymarket is one of a handful of now federally protected "derivatives markets" where you can bet (ahem... trade shares of) anything from how long the the Press Secretary's next press conference will be (don't worry she's definitely not timing it to make sure her bet... ahem... trade wins) or if Kpop Demon Hunters is the best animated feature or the timing of Jesus Christ's return. All with the same basic oversight as a 2007 Credit Default Swap mortgage derivative which definitely went fine for everyone. And the great news? This is no niche thing, Polymarket competitor and major player in the government lobbying that makes it all possible, Kalshi's transaction volume was up 1680% to kick of 2026,

But my interest here is not the bizarreness of gambling being rebranded as investing (I'm looking at you crypto). Or even clear ability for insiders--business and government--to profit wildly over actions that have global consequences. Extraction as the apex of enterprise capitalism is not limited to Polymarket and its friends. Once the free market finds ways to monetize something at this scale, it's been culturally normalized. And that's what's interesting to me.

What has been normalized to make this all possible?

Nobody has any clue what's happening next.

And that, increasingly, is on purpose.

The Permanent Reality Distortion Field

The above phrase, the great RDF, was originally attributed to legendary Apple founder Steve Jobs. To be in a room with him was to be caught up in his definition of the future, facts be damned. He didn't need any market research to know people wanted portable phones with rich visual apps and an always connection to the internet. He knew it to be true, and simply by being near to him, you should know it too. This is also called gaslighting in the modern parlance. The difference between RDF and gaslighting is whether we culturally revere the person who is doing it.

Every day a community of professsionals connects to shake loose the opportunities emerging after the trustbroken era. We call it the Trust-Made Guild. A counterculture of commerce where people can think, learn, connect and reawaken from the frantic lethargy of late-stage capitalism.

But we've been "gaslighting ourselves" as the youths on TikTok say, at least economically for sometime. That's the entire premise of Nassim Nicholas Taleb's famous book series which includes Black Swan, Fooled by Randomness, and AntiFragile. (The last of these is worth every ounce of mental energy you'll spend to read it. I apply its thinking to my work at least once a week and I read it more than a decade ago.)

Essentially, Taleb makes the very strong case that the game is rigged by players at the highest level to obfuscate reality, give the appearance of risk mitigation, only to pile up risk in giant steaming heaps that eventually spontaneously combust in destructive fashion. He has referred to the mass-scaling of the LLM word-prediction machines like ChatGPT and Claude as "self-licking lollipops" a phrase referential to entities that only exist to sustain themselves. Now that LLMs are functionally devouring their own hallucinations and calling it data, a system that used to be 70% right about an 85% accurate prediction of words will now consume that 70% right answer over and over and over again (eating its own output) until it becomes 100%. Fundamentally transforming any users working definition of reality.

Markets and marketeers used to have to disclose "Past Performance is No Guarantee of Future Results" but now that we have ceded reality to LLMs, we must disclose that the "most probabilistic average of the past will be painted writ large as the only possible future." Don't believe me? Ask ChatGPT.

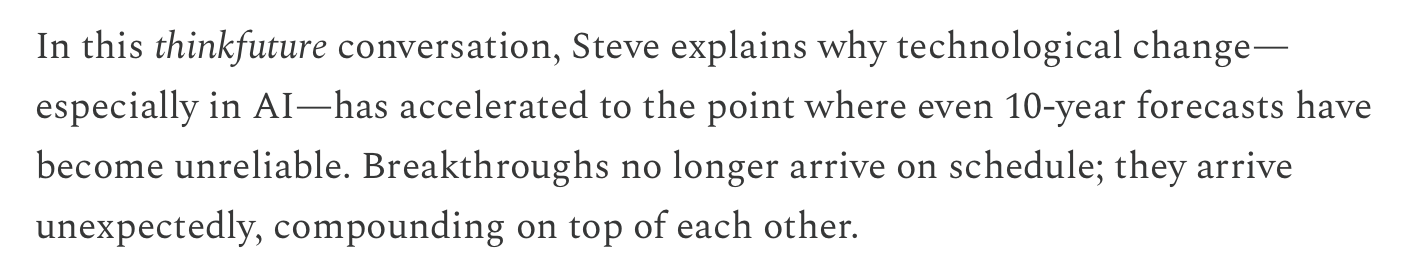

The LLM-driven layer on reality, its overtaking nearly every digital word-and-image-based forum, leads to a permanent Reality Distortion Field where even guessing at the future is a game fundamentally changed. This was explained in detail recently on the thinkfuture podcast with Chris Kalaboukis interviewing Steve Brown, former Intel futurist and AI researcher at Google DeepMind.

Chris's highlights are in the screenshot above (definitely listen to the whole episode): TL;DR? Even if you're dubious about AGI (as I am) our ability to predict what happens next is about as bad as it's ever been. The data-driven revolution has produced a self-induced digital Dark Age, where we're fumbling around having to build ventures, communities, and institutions with almost no clear idea what happens next. It's no wonder economic opportunity once designed for investing in people building companies (markets) is now being redirected toward hype and gambling (poly-markets). If we're all just guessing, we may as well have a good time.

That in mind you might be surprised what I'm going to say next: You've got to build anyway.

Guided by Principle over Prediction

In my work, I spend most days with people trying to make hard decisions. About how to launch a new service offering, where to invest to grow the business, how to frame a complex idea, how to create a culture now that the company has 5xed in the last 12 months.

My clients that thrive have accepted a fundamental truth of our brave new world: Past Performance is No Indication of Future Results. Yes, that old yarn. It's back like it's 1999. Or more like 1929. They recognize that a mass set of no-longer-true constraints created the economic, cultural, and market conditions of the last 30 years, and those conditions: Toast. Gone. Never to Return.

If you're a freelancer or solopreneur you may have been lulled into the retainer/fractional model. And in the process you may be undermining what your clients need from you AND your own revenue at the same time. Good news - you don't have to. Join this free conversation Jan 27 at noon EST

So what's left to do? Can't we all just be more data driven? Well, data can do a job, but as any good data analyst will tell you (moreso now than ever) that the magic in data isn't its collection or observation, it's in the interpretation. It's in seeing the cracks, the themes, the story, and missing idea, the human element that squeezes between the numbers. If we just use the past as a harbinger of the future we are all but assured failure.

We need compasses, not coordinates. Coordinates are based on a cartesian system of certain that has been blown to smithereens by all of the above and then some. We are led by people who thrive and mass produce chaos so they can cherry pick facts to produce narratives to lead by their preferred values. Some people like those values, or at least like some of them and are willing to make trade-offs for them. But the model is universal:

In a time of mass obscuring of reality, you cannot act on probability. You have to act on judgement.

Self-trust is as critical a leadership function as it has ever been. But that self-trust, the ability to look into the fog and step out anyway, is best guided by strategic and principled clarity... something that's hard to generate alone. Leaders are best served by non-leaders who can offer them alternative maps of the befogged landscape. Versions of the topography: It could be Maps A, B or C. And with each map comes a series of choices that will lead you through with certain risks and opportunities. Which map do you want to try?

How you answer that has to be a matter of two things:

- Principle: You have core convictions that drive you and that make you more likely to take a Map A or Map C version of where the road goes.

- Trust: You have confidence in your mapmakers that they haven't attempted to predict the future (a fool's errand) but have traveled enough diverse terrain to know what kind of world's are possible and what risk measures and opportunity dowsing is required.

As a professional wayfinder and mapmaker for growing ventures, I'm sure this all reads as self-affirming. But my guess is it also reads as true. Sometimes, the road does truly rise up to meet us. And where you face the fog of a permanently obscure future, and two roads in a wood diverge (or three or four or five or six) I would very interested to meet you there and see what we can see, together.

There's an 91% chance it'll be a transformational success.

Stay brains on, heart open, forward progress.